A net loss would decrease retained earnings so we would do the opposite in this journal entry by debiting Retained Earnings and crediting Income Summary. If expenses were greater than revenue, we would have net loss. How do we increase an equity account in a journal entry? We credit! What did we do with net income? We added it to retained earnings in the statement of retained earnings. We want to remove this credit balance by debiting income summary. The balance in income summary now represents $37,100 credit – $28,010 debit or $9,090 credit balance…does that number seem familiar? It should - income summary should match net income from the income statement. The total debit to income summary should match total expenses from the income statement.Īt this point, you have closed the revenue and expense accounts into income summary. Just like in step 1, we will use Income Summary as the offset account but this time we will debit income summary. The expense accounts have debit balances so to get rid of their balances we will do the opposite or credit the accounts. The credit to income summary should equal the total revenue from the income statement. We will debit the revenue accounts and credit the Income Summary account. To make them zero we want to decrease the balance or do the opposite.

#Due to due from closing journal entries trial

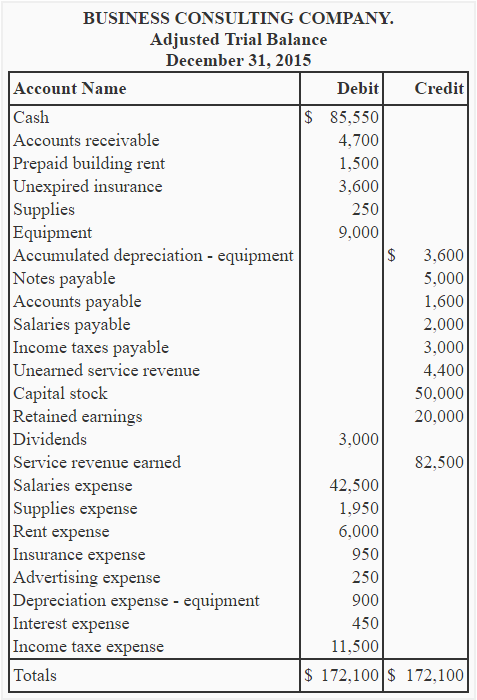

We see from the adjusted trial balance that our revenue accounts have a credit balance. We need to do the closing entries to make them match and zero out the temporary accounts.Ĭlose means to make the balance zero. Notice how the retained earnings balance is $6,100? On the statement of retained earnings, we reported the ending balance of retained earnings to be $15,190. We will look at the following information for MicroTrain from the adjusted trial balance: We use a new temporary closing account called income summary to store the closing items until we get close income summary into Retained Earnings. If we want to make the account balance zero, we will decrease the account. Let’s review what we know about these accounts:

Closing the revenue accounts-transferring the credit balances in the revenue accounts to a clearing account called Income Summary.The four basic steps in the closing process are: Only revenue, expense, and dividend accounts are closed-not asset, liability, Common Stock, or Retained Earnings accounts. In accounting, we often refer to the process of closing as closing the books.

#Due to due from closing journal entries how to

The following video summarizes how to prepare closing entries. Remember how at the beginning of the course we learned that net income is added to equity. The goal is to make the posted balance of the retained earnings account match what we reported on the statement of retained earnings and start the next period with a zero balance for all temporary accounts. The closing entries are the journal entry form of the Statement of Retained Earnings. The closing process reduces revenue, expense, and dividends account balances (temporary accounts) to zero so they are ready to receive data for the next accounting period.Īccountants may perform the closing process monthly or annually. These account balances do not roll over into the next period after closing.

0 kommentar(er)

0 kommentar(er)