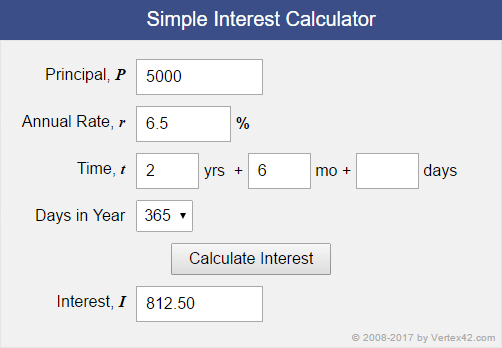

Now, as you get familiar with the financial jargon used in loan constructions and with the loan payment formula, let's see how to calculate loan payments through a simple example. The other type of loan construction is based on compound interest, where the interest amounts are added to the principal balance after every specific period corresponding to the compound frequency. It is important to note that the loan payment formula above is based on amortized loan construction with equal payments where the interest amounts are computed after the unpaid principal. Periodic loan payment = Loan amount / (((1 + Periodic rate) ^ Number of payments) - 1) / (Periodic rate × ((1 + Periodic rate) ^ Number of payments)). In other words, the more loan has been paid back, the higher the share of the principal in an installment.Īfter taking a quick journey through financial terminology, we can construct the loan payment formula applied in our loan calculator. The share of interest is higher at the beginning of the loan term, but it declines as the loan balance decreases. Loan payment schedule/Amortization schedule: each loan payment consists of two parts: part interest and part of the repayment of the principal. This kind of loan construction is called an amortized loan. In most cases the borrowed money is refunded in loan payments (installments) in equal amounts through the payment term. Loan payment: this is the amount of money which is required to be repaid by the borrower for every payment period. For example, in the case of a monthly payment with a 6% annual rate, the periodic interest rate is equal to 6% / 12 = 0.5%. To get the periodic interest rate, you need to divide the annual rate by the number of payments in a year. For example, a bank might charge 2% per month on its credit card loans, or it might charge 1% quarterly on loans. It can be annual (in this case, it equals the annual rate), semiannual, per quarter, per month, per day, or per any other time interval. Periodic rate: this is the interest rate charged by a lender or paid by a borrower in each payment period. Payment period: it refers to the specific period over which the borrower is obliged to make the loan payments. For example, a 20-year fixed-rate mortgage has a term of 20 years mortgage calculator. Payment term: in our context, refers to the time frame the loan will last if you only make the required minimum payments each month. To learn more about inflation, visit our inflation calculator. It is also important to take into account the expected inflation rate when you inspect a quoted rate: the higher the inflation rate, the lower the real interest rate thus, the real burden generated by the interest rate lessens. If you would like to learn more about calculating interest, visit our simple interest calculator.Īnnual rate: this is the interest rate (also called nominal rate or quoted rate) that is quoted by banks (or other parties).

In other words, this is the amount that the borrower agrees to pay the lender when the loan becomes due, not including interest. Loan amount: this is the amount of money (also known as the principal) that a bank (or any other financial institution) lends or, conversely, that an individual borrows. In the following, you can get familiar with these phrases so you will have more of an understanding of the concept of loans. Before we go any further, it is essential to discuss a few specific terms you may encounter when you are considering taking a loan.

0 kommentar(er)

0 kommentar(er)